Bynoe Lithium Project

Bynoe Lithium Project (100%)

Efficient and Cost-Effective Advancement Towards Development

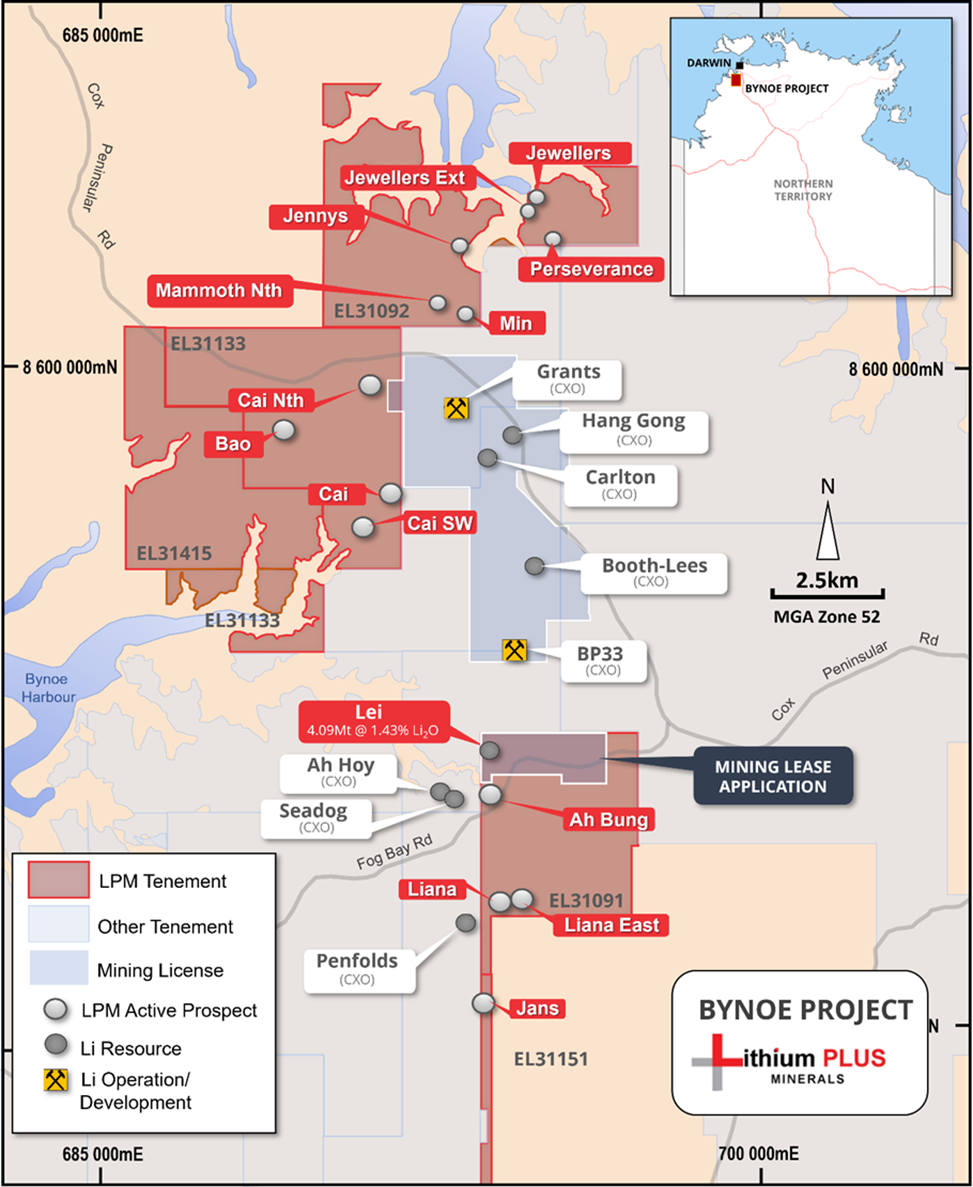

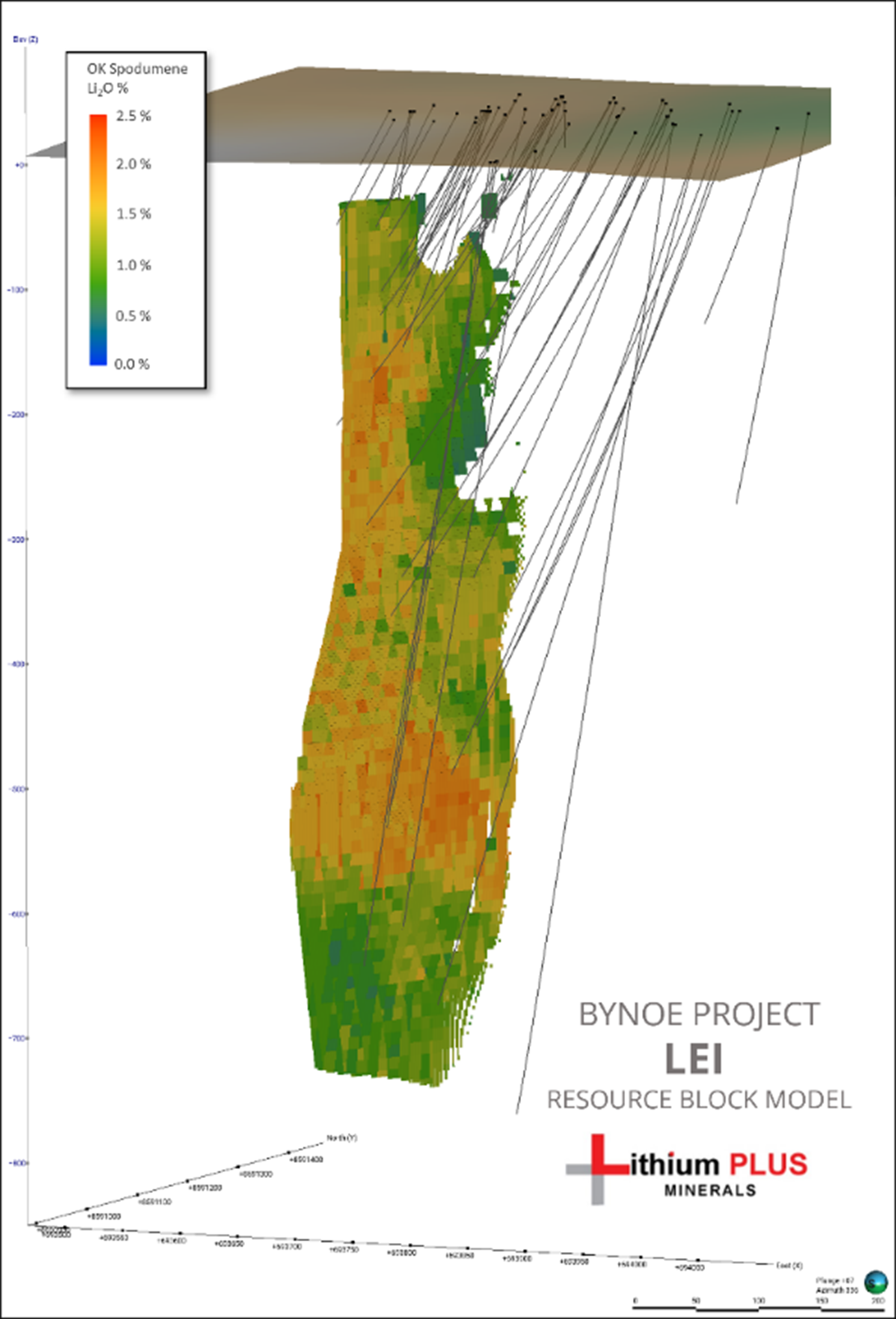

Lithium Plus is advancing the Bynoe Lithium Project, strategically located on the Cox Peninsula, approximately 71.5 kilometres by road from Darwin Port in the Northern Territory. The project hosts the high-grade Lei Deposit, which boasts a Mineral Resource Estimate (MRE) of 4.09 million tonnes at 1.43% Li₂O, positioning it among Australia’s premier up and coming lithium deposits.

Lei Lithium Deposit Development

The company is progressing the development of an underground mine at the Lei Deposit. The planned operation involves a Direct Shipping Ore (DSO) project, where ore will be crushed and screened on-site before transportation to Darwin Port. Subsequently, the ore will be processed into lithium hydroxide or carbonate at Canmax Technologies Co., Ltd’s facility in China.

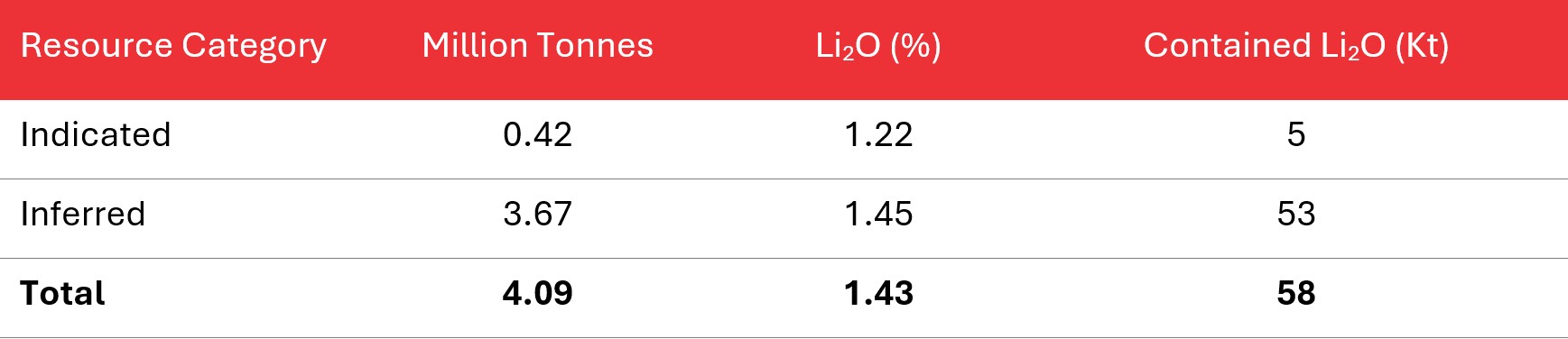

Mineral Resources

The MRE for the Lei Deposit, as announced on 19 December 2023, is summarised in the table below (at a 0.5% Li2O cutoff):

No Measured category has been classified at this time.

Offtake Agreement with Canmax

In June 2024, Lithium Plus entered into a non-binding Memorandum of Understanding (MoU) with Canmax Technologies Co., Ltd (XSHE: 300390) regarding a spodumene offtake agreement. The MoU encompasses:

- Offtake Volume: 50% of all DSO and spodumene concentrate produced from the Lei Project, with an option for Canmax to purchase additional product, subject to availability.

- Pricing Structure: Based on a percentage of Canmax’s profit from lithium hydroxide/carbonate sales, factoring in mining, transportation, and processing costs at Lei.

- Project Financing: Canmax has agreed to support project financing arrangements for the Lei Project.

This profit-sharing structure enables Lithium Plus to economically benefit from Canmax’s downstream lithium processing capabilities, providing early cash flows while avoiding the substantial capital expenditure required for a downstream lithium processing facility.

Ore Sorting

As part of its economic assessment, Lithium Plus engaged global ore sorting technology specialists Stark Resources GmbH to conduct initial ore sorting trials on ore from the Lei Deposit. The trials delivered positive results:

- Head Grade: Achieved a 2.52% Li₂O head grade, representing a 51% uplift.

- Mass Yield: 57.8%

- Iron Content: Exceptionally low, at <0.23% Fe₂O₃

- Waste Reduction: Approximately 42% of the ore was reduced into a waste stream containing just 0.5% Li₂O.

- Lithia Recovery: Over 87% recovery

These results underscore the strong potential for improved economic outcomes in a planned DSO commercialisation pathway.

Metallurgy

The Lei Deposit ore, primarily coarse spodumene, has demonstrated high amendability to benefication through multiple processing routes:

- Whole-of-Ore Flotation Test: 79.5% recovery to a concentrate grading 6.05% Li₂O.

- DMS plus Fines and Middlings Flotation (High-Grade Sample): 85.3% recovery to a concentrate grading 6.12% Li₂O.

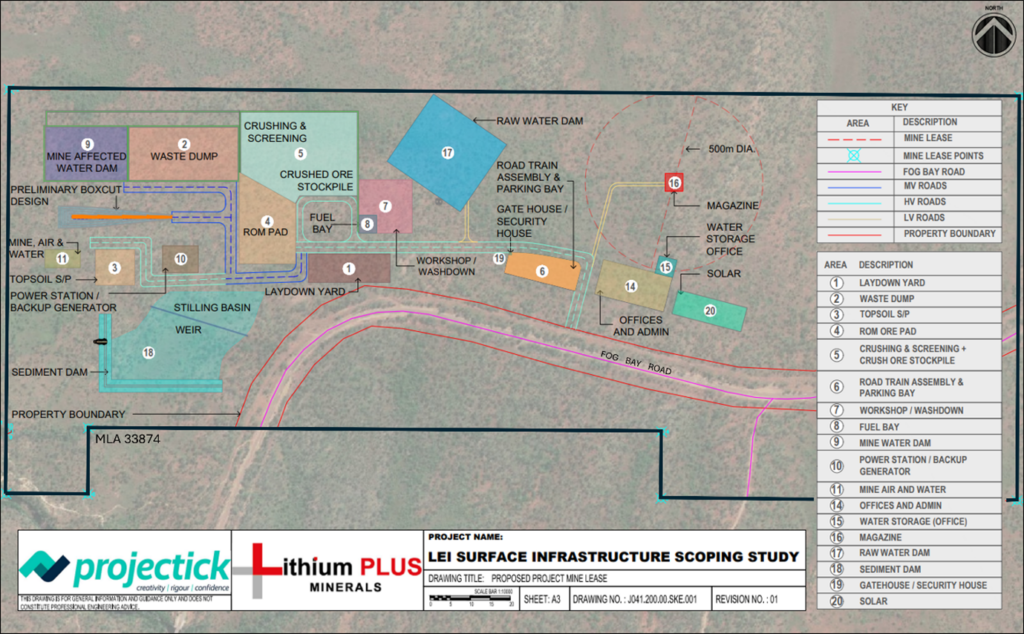

Mine and Surface Infrastructure Design

The proposed Stage 1 DSO development at Lei includes:

- An underground mine with a covered box cut and portal entry.

- Crushing and screening facilities.

- A road train loading area for ore transport to Darwin Port.

The mined spodumene ore is expected to be exported to China for procesing at Canmax’s conversion plant, producing lithium hydroxide for global battery manufacturers.

Mining Lease Application

The Mining Lease application covers 295 hectares, including the existing Lei MRE. The application area extends to highly prospective zones of lithium mineralisation adjacent to the deposit, including a second pegmatite at Lei yet to be incorporated into the MRE.

Environmental Referral

The Environmental Referral has been prepared by EcOz Environmental Consultants on behalf of Lithium Plus and was submitted in October 2024. A positive notice of decision and statement of reasons have been received from the Northern Territory Government’s Department of Lands, Planning, and Environment, confirming the pathway for environmental approval through a Supplementary Environmental Report (SER). Supplementary studies are underway to support the SER submission.

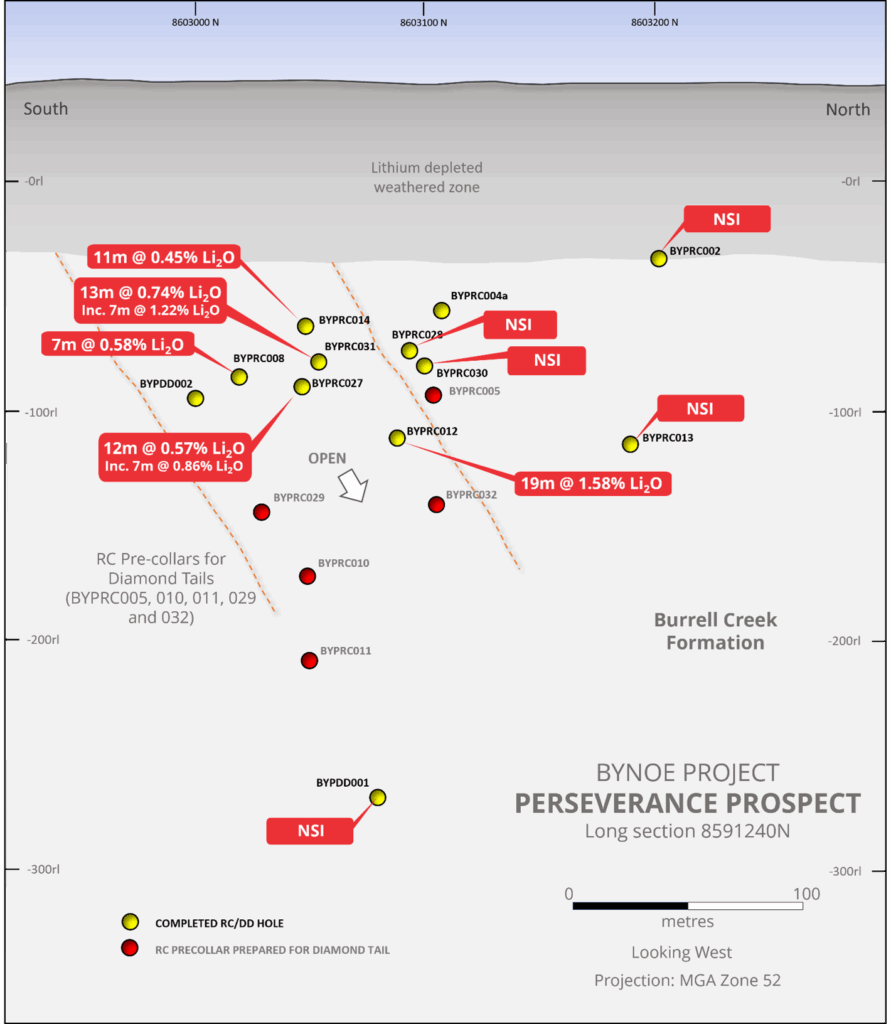

Perseverance Prospect

The Perseverance pegmatite is located within an old prospect area comprising several small pits and a shallow shaft with no historical record of Sn-Ta production. The Prospect is exposed in a series of trenches exposing a 100m long, north-north-east striking pegmatite up to 10m wide. Additionally, a 100m long, 65m wide podiform pegmatite body is exposed to the south of the main body.

A total of fourteen (14) RC/DD drill holes have been completed at Perseverance to date, with the latest round of drilling comprising six (6) RC holes for approximately 900m. The program was designed to follow up encouraging results from earlier drilling in 2023 which confirmed spodumene mineralisation in fresh pegmatite, including:

- 19m @ 1.58% Li2O from 148m (BYPRC012), including:

- 4m at 2.62% Li2O.

The shallow drill program extended mineralisation at surface and between existing holes aiding definition of the plunge and extent of the existing high-grade zone.

Assay results from an additional two (2) Perseverance Prospect holes intersected significant spodumene mineralisation, including:

- 7m at 0.86% Li2O from 135m (BYPRC027) in a broader zone of 12m @ 0.57% Li2O; and

- 7m at 1.22% Li2O from 110m (BYPRC031) within a broader zone of 12m @ 0.79% Li2O.

Four (4) RC pre-collar holes (BYPRC010, BYPRC011, BYPRC029 and BYRC032) will be completed with diamond drill hole tails (refer Figure 4). These four holes have been designed to intersect down plunge under the best intersection to date (BYPRC012). The current drilling favours an interpretation of a steep plunge to the south that increases in width and grade at depth.

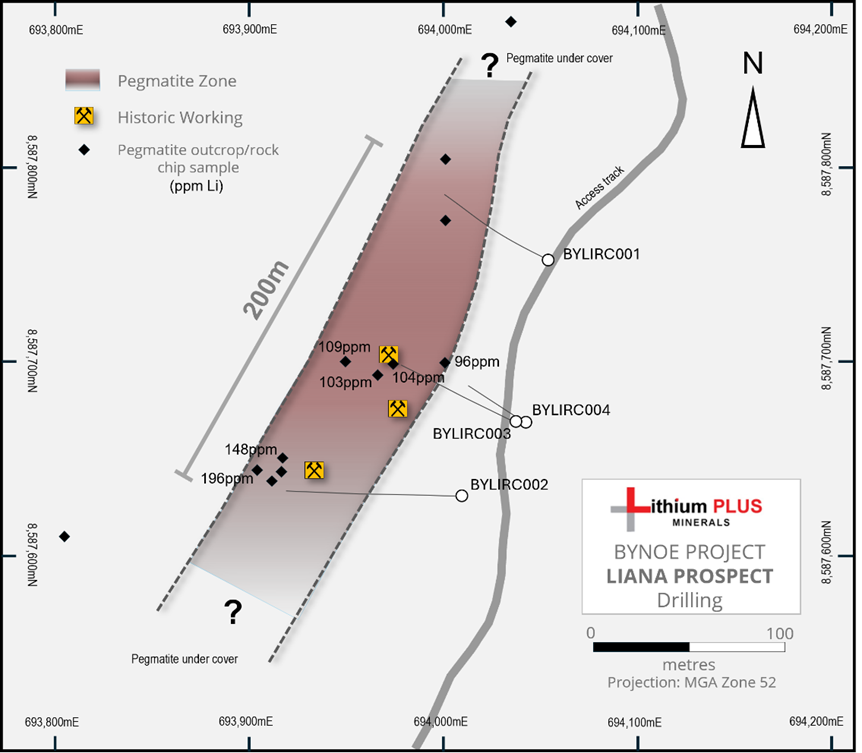

Liana Prospect

- A four-hole, 600m Reverse Circulation (RC) drilling program was completed at the Liana Prospect late last year, immediately prior to the onset of the wet season.

- Significant pegmatite intervals up to 20m thick (including both weathered and fresh material) were intersected downhole beneath historical tin workings.

- Two of the holes require follow-up, deeper RC and/or diamond tail drilling to fully intersect the pegmatite. These holes were suspended due to deteriorating drill pad conditions.

- Assay results from two sampled holes returned no significant spodumene or lithium grades above 0.2% Li₂O. The remaining holes will test for deeper spodumene-bearing pegmatite when conditions allow.

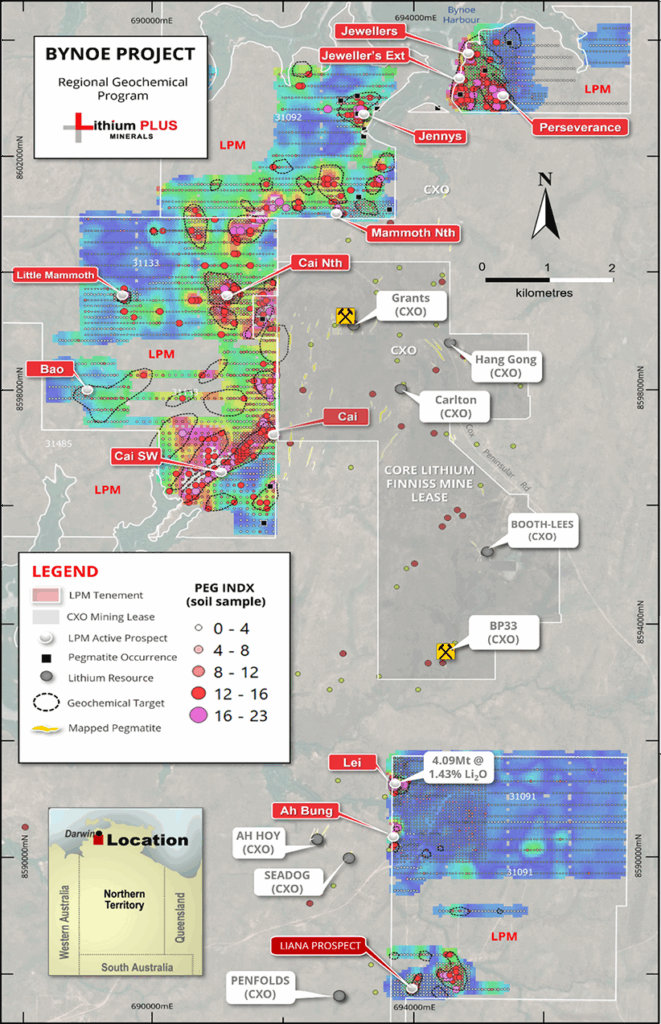

Cai and SW Cai

- Historical 2017 drilling at Cai was too shallow and intersected weathered pegmatite where lithium is likely depleted due to weathering, failing to test beneath the weathering profile.

- Anomalous lithium (300–500 ppm) values at Cai from drilling are within the same range as shallow drill holes at Lei, which, when drilled 50m deeper, intersected 12m @ 1.43% Li₂O.

- Deeper drilling at Cai is expected to intersect higher lithium values similar to Lei.

- Cai and SW Cai lie along a strong southwest trend that aligns with Core Lithium’s Far West Central and Grants prospects.

Numerous untested pegmatite systems

- The Bynoe region is home to hundreds of historically known pegmatites which typically occur in clustered linear swarms ranging in surface area from a few square meters up to hundreds of square meters. In the region, pegmatites are generally poorly exposed at surface due to subdued relief, extensive weathering profiles and thick vegetation. Better exposures of pegmatite are often found in historical artisanal workings, and exploration costeans observed as highly weathered clay-quartz (smectite-kaolinite) saprolite. More often, the surficial expression of the known pegmatites is typically defined by residual ‘scattered’ pegmatite float comprising resistant quartz and mica. The presence of lithium minerals is absent (removed, if present, by the weathering process), and outcrops are rare.

- To rapidly and cost effectively screen broad prospect areas and identify prospective pegmatite targets, Lithium Plus deployed a program of broad systematic soil geochemistry grids along with reconnaissance mapping of pegmatite float trails.

- The program was conducted through the second half of 2022 with over 3,700 soil geochemistry samples taken across EL 31091, EL 31092 and EL 31133. Samples were initially taken on east west traverse lines spaced 200m apart with samples taken at 50m spacing along the traverse lines. Infill sampling at a 50m square grid spacing was conducted on high priority areas to refine the broader soil anomalies (refer ASX announcement, 27 April 2023).

- Calibration of the soil geochemical results with known pegmatite occurrences within the survey area (e.g. Lei) demonstrate that high concentrations of Li, Cs, Ta, Rb, Be and Sn (the ‘pegmatite index’), are indicative of lithium-enriched pegmatites.

- As anticipated, the survey program was highly successful in defining numerous pegmatite targets of elevated and anomalous lithium with associated pathfinder elements.

- More than fifteen (15) drill ready pegmatite targets defined based on elevated and anomalous lithium with associated pathfinder elements, and outcropping to sub-cropping pegmatite.

Project Background

Situated on the Cox Peninsula, 45 km south of Darwin, at the northern end of the Litchfield Pegmatite Belt, Lithium Plus Minerals Ltd holds eleven granted tenements covering 297 km². Geologically centred around the Bynoe Pegmatite Field, the tenements share a border with Core Lithium Ltd’s (ASX: CXO) Finniss mine development. Lithium Plus Minerals is currently developing plans for the Lei Deposit. A maiden JORC Mineral Resource of 4.09 Mt at 1.43% Li₂O was announced on 19 December 2023.

In June 2024, the Company applied for a Mining Lease over Lei and announced a non-binding MoU with Canmax for 50% offtake of spodumene DSO and concentrate. An extensive exploration program is ongoing in parallel with an early-stage economic assessment of the Lei Deposit’s development potential.

The Bynoe region is now recognised as a world-class lithium district, with significant lithium resources and exploration potential associated with spodumene-bearing pegmatites. Its proximity to Darwin provides a distinct economic advantage, with regional infrastructure such as roads and port offering ready-made access to export markets. The pegmatite quality is recognised for its simple mineralogy, coarse texture, and high grade—features that support low-cost concentrate production or direct shipping.

The region hosts Core Lithium Ltd’s Finniss Operations, which commenced production at the Grants Deposit in 2023 and is currently in care and maintenance. In May 2025, Core published a restart study outlining the technical and economic robustness of an operation with a 20-year mine life and potential for future expansion. The study included updated Ore Reserves and Exploration Targets for the Blackbeard and BP33 Deeps deposits.

Lithium in the Bynoe Pegmatite Field is hosted within LCT (lithium–caesium–tantalum) pegmatites that range from narrow veins to broad, lozenge-shaped bodies up to 500 metres long and 60 metres wide. These are poorly expressed at surface as highly weathered clay-quartz (smectite–kaolinite) saprolite. To date, lithium resources have been defined for 12 individual pegmatite-hosted deposits within this field.

Ongoing exploration by multiple companies is expected to significantly grow the resource base in the Bynoe Pegmatite Field through systematic assessment of over 100 historic prospects recognised (and historically worked) during the main phase of tin–tantalum exploitation in the 1980s.